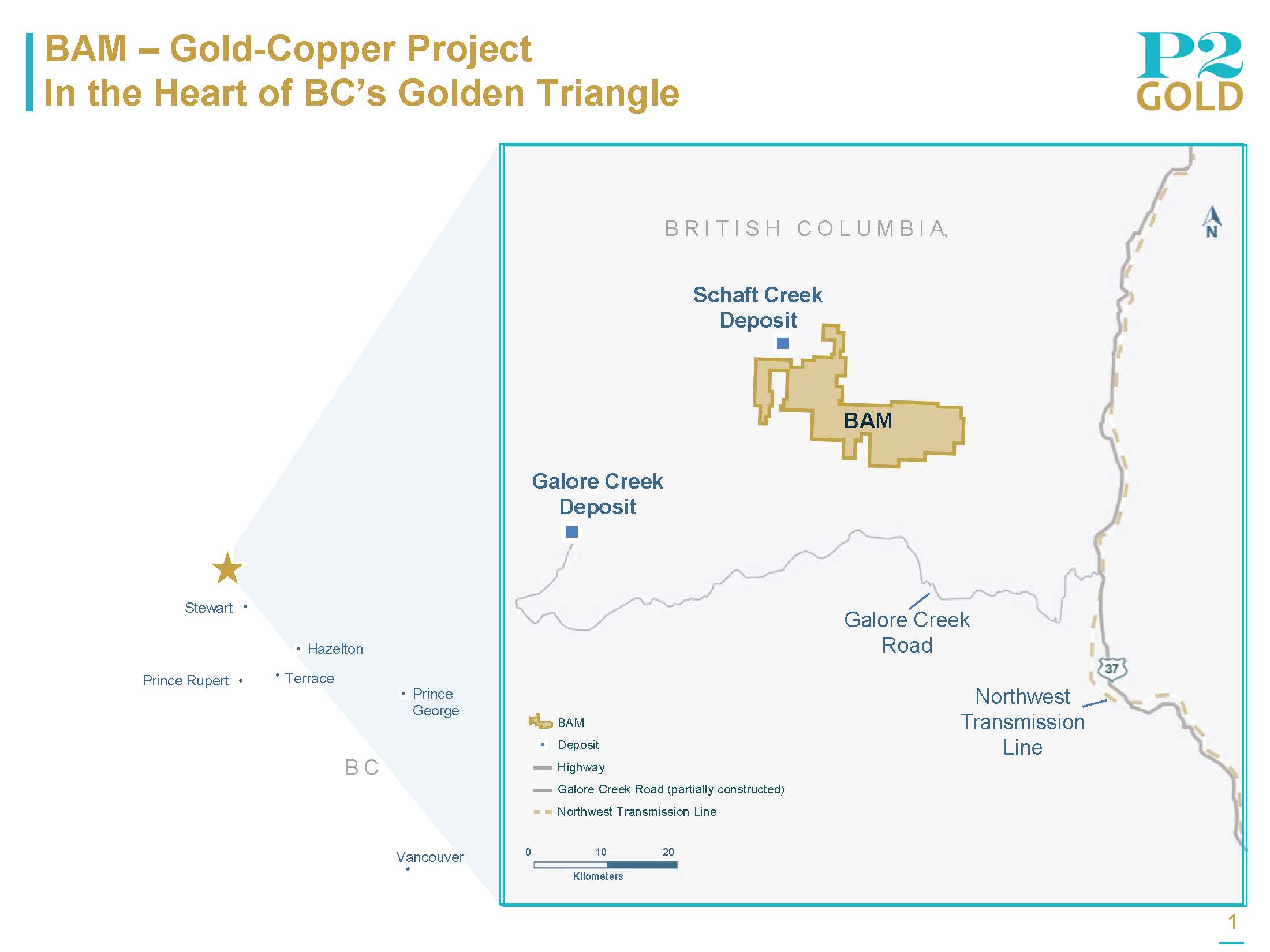

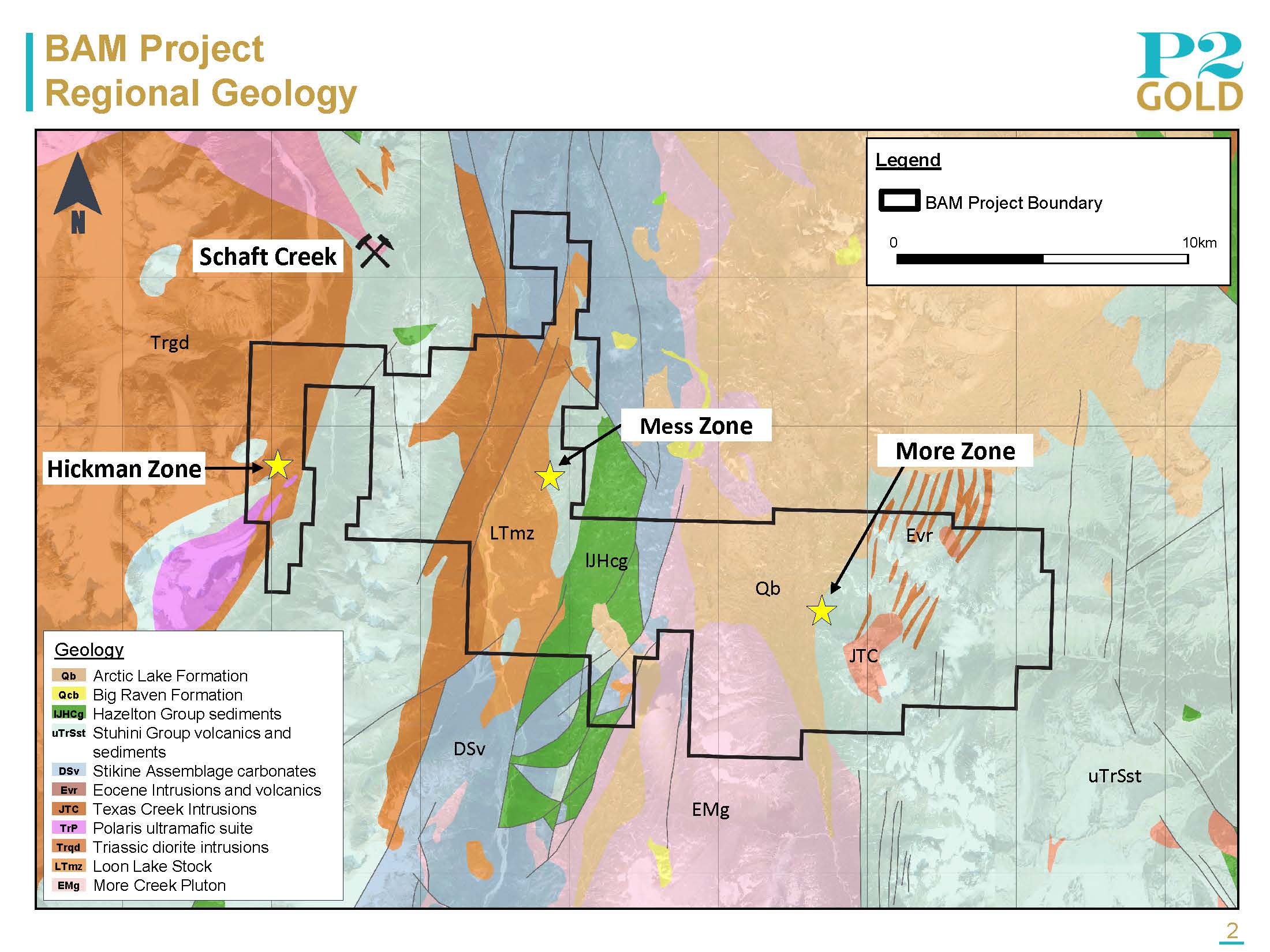

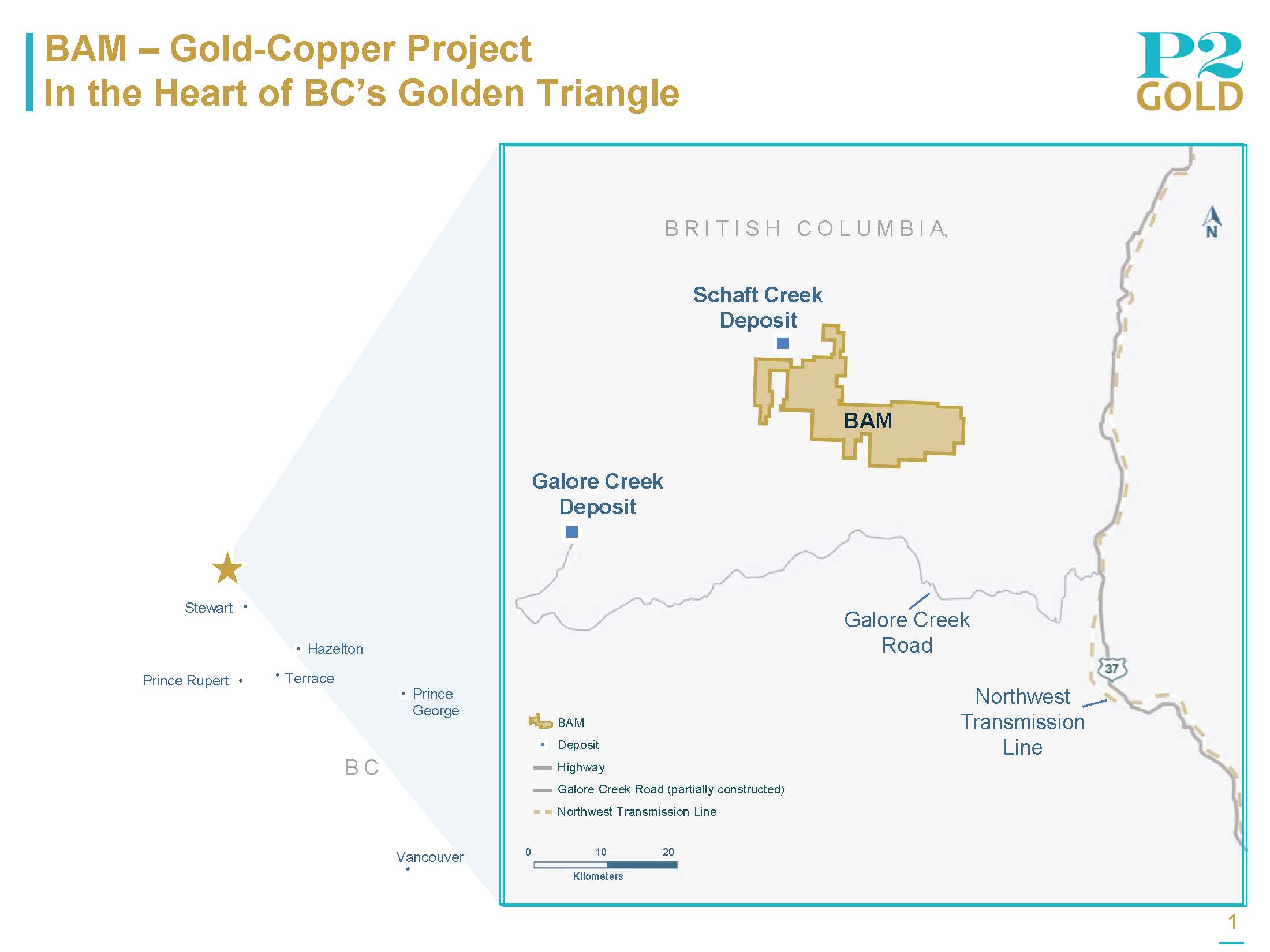

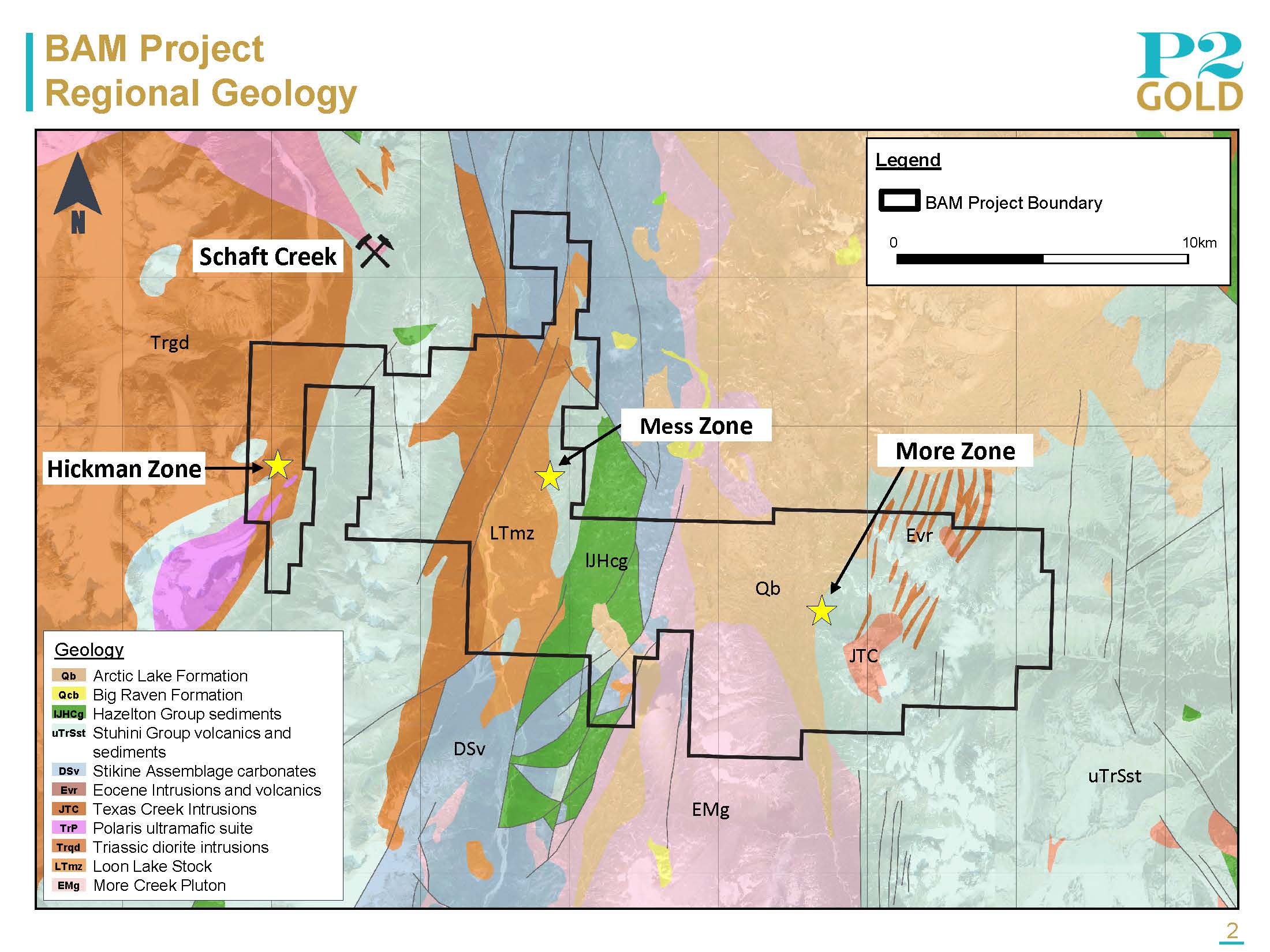

P2’s wholly-owned BAM Project is a resource-stage gold-copper exploration project within a well-known area of British Columbia’s Golden Triangle.

The BAM Project comprises 54 claims totalling 18,893 hectares acquired by P2 Gold in March 2023 (see P2 Gold news release dated March 7, 2023). The BAM Project is located approximately 150 kilometers northwest of Stewart, BC. BAM is accessed by helicopter, and has good access to existing infrastructure, with Highway 37 and the Northwest Transmission Line approximately 35 kilometers to the east of the project, and the Galore Creek Project access road approximately 10 kilometers to the southeast.

The focus of the BAM Project is the More Creek Zone located approximately five kilometers east of Arctic Lake, and approximately eight kilometers northeast of the Monarch Gold Zone, an area where prior exploration work had been conducted by P2. (See P2 Gold news release dated December 20, 2023). The More Creek Zone is defined by a strong gold/copper soil anomaly measuring one-by-one kilometers, is open to the west, and within which numerous rock grab samples returned values ranging from 0.1 to 0.6 gpt gold and 0.2% to 0.4% copper.

Quality Assurance

Ken McNaughton, M.A.Sc., P.Eng., Chief Exploration Officer, P2 Gold, is the Qualified Person responsible for the BAM Project exploration programs and has reviewed, verified and approved the above scientific and technical information.